Shopify merchants have had to rely on third-party payment providers to process transactions for years. This often meant high costs, not to mention complex integrations and potential delays in payouts. Now, Shopify Payments is becoming more and more popular, offering an all-in-one payment solution built directly into Shopify.

With frictionless checkout experience and lower transaction fees, Shopify Payments aims to simplify online sales for eCommerce businesses. It supports major credit and debit cards, as well as digital wallets like Apple Pay and Google Pay.

Following the big news that Shopify Payments has been recently enabled for Polish merchants, it’s a great moment to take a closer look at the solution. Is it the right choice for your business? In this article, we’ll break down how Shopify Payments works, what costs to expect, and why it might be a game-changer for your store.

How Shopify payments works

In essence, Shopify Payments is an integrated payment gateway that allows Shopify merchants to accept payments directly through their store without relying on third-party providers. This simplifies the checkout process on the customer’s end, while also reducing operational complexity for you as the business owner. Let’s take a look at its main features in closer detail.

Step 1: Enabling Shopify payments

Merchants can activate Shopify Payments directly in their Shopify admin panel. Once enabled, it becomes the default payment gateway, eliminating the need to configure external payment processors.

Step 2: Accepting payments

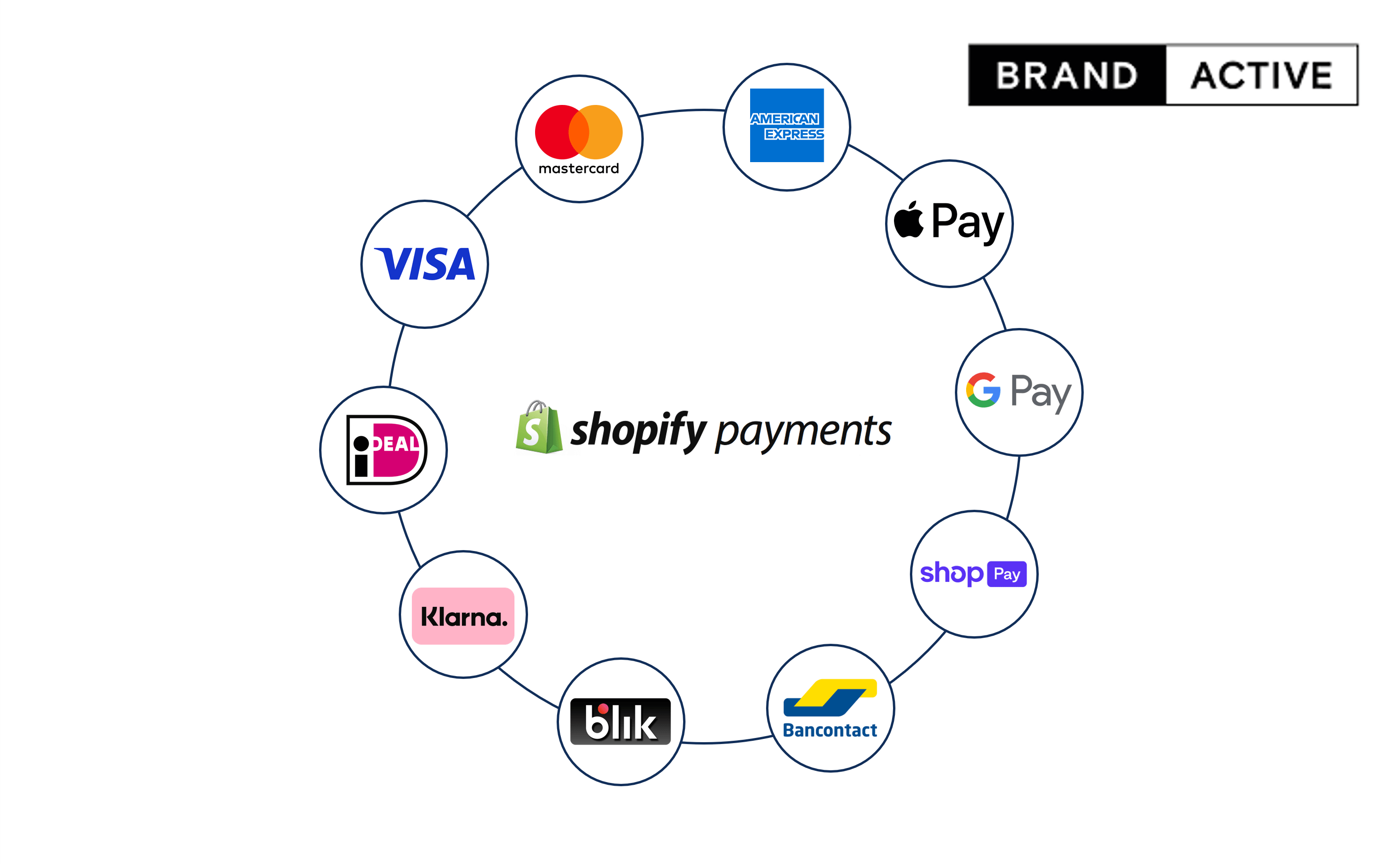

Shopify Payments automatically supports multiple payment methods, ensuring that customers can choose the option that suits them best. Currently, it supports:

- Major credit and debit cards (Visa, Mastercard, American Express)

- Digital wallets (Apple Pay, Google Pay)

- Local payment methods such as BLIK and bank transfers (expected soon)

Because Shopify Payments is fully integrated, customers complete their transactions without being redirected to third-party checkout pages, which reduces cart abandonment.

Step 3: Processing and security

All transactions are securely processed within Shopify’s ecosystem, ensuring full compliance with PSD2 regulations and built-in fraud detection. The system also includes chargeback protection and automated fraud analysis, which minimize risks for merchants.

Step 4: Payouts to your bank account

Funds from completed transactions are automatically transferred to the merchant’s bank account within a predefined payout schedule. Shopify Payments provides transparent reporting in the admin panel, allowing store owners to track their cash flow with real-time insights.

By eliminating the need for third-party payment gateways, Shopify Payments simplifies payment processing, improves security, and ensures a smoother checkout experience for both merchants and customers.

5 reasons why you should consider Shopify Payments for your Shopify Store

Choosing the right payment gateway is critical for any eCommerce business. Shopify Payments offers several advantages that can help merchants reduce costs. Here are the crucial ones.

1. No additional transaction fees

When using Shopify Payments, merchants do not pay additional Shopify transaction fees. External payment gateways typically incur extra charges on top of standard processing fees, making Shopify Payments a more cost-effective choice.

2. Faster payouts

With third-party payment providers, funds often take longer to reach your bank account due to intermediary processing. Shopify Payments automates payouts, ensuring that funds from completed transactions are deposited within a few business days. This means better cash flow and fewer delays.

3. Seamless checkout experience

A frictionless checkout process is essential for reducing cart abandonment. Shopify Payments keeps customers on your store’s checkout page, eliminating redirects to third-party payment processors. This provides a more professional and trustworthy shopping experience, increasing the likelihood of successful transactions.

4. Built-in fraud protection and compliance

Shopify Payments includes automated fraud detection and chargeback protection, helping merchants minimize risk. The system is also fully compliant with PSD2 regulations, ensuring a secure and legally compliant payment process in Poland.

5. Future-Proofing your store

Shopify continues to expand and improve Shopify Payments, with support for local Polish payment methods such as BLIK and direct bank transfers expected soon. Merchants adopting Shopify Payments early may benefit from exclusive features, priority support, and ongoing platform improvements.

Costs and fees for Polish merchants: what you need to know

Shopify Payments offers Polish merchants a transparent fee structure, eliminating the need for third-party payment providers and their additional transaction fees. Below is a breakdown of the key costs associated with Shopify Payments in Poland.

Card Transaction Fees

The payment processing fees for card transactions depend on the Shopify plan:

- Basic Shopify: 1.95% + 1.20 PLN per transaction

- Shopify: 1.8% + 1.20 PLN per transaction

- Advanced Shopify: 1.65% + 1.20 PLN per transaction

- Shopify Plus: Custom rates starting from 1.45% + 1.20 PLN per transaction

If a merchant chooses to use an external payment gateway instead of Shopify Payments, Shopify applies an additional transaction fee:

- Basic Shopify: 2% per transaction

- Shopify: 1% per transaction

- Advanced Shopify: 0.5% per transaction

- Shopify Plus: 0.15% per transaction

By using Shopify Payments, merchants avoid these extra Shopify transaction fees, making it a more cost-effective solution.

Currency Conversion Fees

If a store sells in a currency different from its payout currency, Shopify applies a 2% currency conversion fee on each transaction. However, Advanced Shopify and Shopify Plus users can configure multi-currency payouts, reducing or eliminating these conversion fees by linking multiple bank accounts in different currencies.

Payout Schedule

Funds from transactions processed through Shopify Payments are automatically deposited into the merchant’s bank account. Standard payout times in Poland are expected to be a few business days after the transaction is completed. The exact deposit timing depends on the merchant’s payout schedule and bank processing times.

With clear pricing, no hidden fees, and deep Shopify integration, Shopify Payments is a cost-efficient and convenient payment solution for Polish merchants.

How to Set Up Shopify Payments in Poland

As of February 2025, Shopify Payments is in early access in Poland and is available only to certain merchants. To set up Shopify Payments, follow these steps:

Step 1: Verify Eligibility

Ensure your business meets the following criteria:

- Business Registration: Your business must be registered in Poland.

- Bank Account: You need a bank account with an EU or Poland-based bank in EUR or PLN, eligible for SEPA transfers, and capable of accepting debits. The IBAN should start with one of the following: AT, BE, CH, DE, DK, EE, ES, FI, FR, GB, GI, IE, IT, LU, NL, NO, PL, PT, SE, RO.

- Prohibited Businesses: Confirm that your business type is not listed in Shopify’s prohibited business types for Poland.

Step 2: Activate Shopify Payments

- Access Shopify Admin: Log in to your Shopify admin panel.

- Navigate to Payments Settings: Go to Settings > Payments.

- Activate Shopify Payments: In the Shopify Payments section, click Activate.

- Provide Required Information: Enter necessary details about your business and personal information as required.

- Submit Documentation: You may need to provide documents such as a passport, driver’s license, or identity card for verification.

Step 3: Configure Payment Methods

Once activated, Shopify Payments allows you to accept various payment methods:

- Credit/Debit Cards: Visa, Mastercard, American Express, UnionPay debit and credit cards.

- Digital Wallets: Apple Pay, Google Pay, and Shop Pay.

- Local Payment Methods: Bancontact, Blik, Klarna, and iDEAL.

Step 4: Set Up Payouts

Funds from transactions are transferred to your bank account based on Shopify’s payout schedule:

- Pay Period: In Poland, the pay period is 3 business days.

- Minimum Payout Amount: The minimum amount that can be paid out is €1 EUR.

Step 5: Ensure Compliance and Security

To comply with regulations and ensure account security:

- Two-Step Authentication: Activate two-step authentication on your Shopify account.

- Regular Updates: Keep your business and personal information up to date to avoid disruptions.

By following these steps, you can set up Shopify Payments in Poland, providing a seamless and integrated payment experience for your customers.

Final thoughts

Shopify Payments is a game-changer for Polish Shopify merchants. It offers a fully integrated payment solution that simplifies transactions, reduces costs, and improves the checkout experience. By eliminating additional transaction fees for Shopify users and providing faster payouts, it presents an efficient and cost-effective alternative to third-party payment providers.

As this is a newly introduced feature in Poland, Shopify Payments is still evolving. Shopify has confirmed plans to expand its support for local payment methods, including BLIK and direct bank transfers, further enhancing its appeal for Polish businesses.

If you’re wondering whether Shopify Payments is the right fit for your business, we’re here to help. During a free 30-minute consultation, we’ll:

- Assess how Shopify Payments aligns with your current setup

- Discuss potential savings and improvements in transaction efficiency

- Guide you through the setup process and optimization strategies

Want to learn more? Let’s talk.